Retirement Savings Plan (also called the 403(b) Plan)

All regular employees, full-time AND part-time, are eligible for the Retirement Savings Plan (403B).

Regular full-time employees are automatically enrolled in the Retirement Savings Plan at a contribution of 2% of pay. Your contribution rate will increase by 1% each year (starting in 2010) until you reach a contribution rate of 8%, which is the maximum matched contribution rate.

Part-time employees are auto enrolled at 0%. If you are a part-time employee and wish to begin contributing to your Retirement Savings Plan (403B) you can log into your account or you can contact OneAmerica at 844-272-4463 and they will assist you with your contribution.

Part-time, seasonal or temporary employees who move to a regular full-time status must also contact One America to begin contributions. You will not be auto-enrolled at 2%.

Accessing Your Account

You will receive a personalized account statement after each calendar quarter. You can also access your account online or by calling OneAmerica.

Your savings and investment returns will make up a significant portion of your retirement income. To help you stay connected to your account, OneAmerica offers online access. To access your account, you must first register in the system.

To keep your retirement funds secure, it is recommended to create and online account. This will help prevent fraudulent attempts to move your money. You should also ensure your correct email address is listed and you are set up for e-notifications. Should any changes be made to your account, you will receive a confrimation email.

Access:

1. Log on to

https://pages.oneamerica.com/archindyretire and register. If you’re a new hire, you may not have access until about your 2nd or 3rd paycheck.

2. If you can’t remember your user ID or password, you can use the forgot user ID or password option OR you can contact OneAmerica at 844-272-4463.

To change your deferral, access your account as shown above and then:

1. Choose “My Plan” at the top of the screen in the menu bar

2. Choose “Contributions” from the drop down selection

3. Under the Modify contribution amount indicate the % of salary you wish to have withheld per pay period

4. Click “Continue” then click on “Submit Contribution”

Note: it may take up to 10 business days before this change is recognized on your paycheck

Things you can do online:

- Start saving for retirement

- Add or Change your email address

- Change your salary deferral (the percentage saved on a pre-tax basis from your pay)

- View your account balance and investment elections

- View your transaction history

- Change your investment elections

- Produce a statement on-demand using data you select

- See the performance and expense ratios of available investment options

- Change your beneficiary

Auto enrollment

Your savings contributions are made on a before-tax basis as a percentage of your pay. If you were hired after July 1, 2008 as a new full-time employee, you will be automatically enrolled in the Retirement Savings Plan at a contribution rate of 2% of pay. Your contribution rate will increase by 1% each year (starting in 2010) until you reach a contribution rate of 8%, which is the maximum contribution rate we match (see Matching Contributions described below).

Part time employees are auto enrolled at 0%. If you wish to contribute you will log into your Retirement Savings Plan (403B) or you can call OneAmerica at 844-272-4463.

Funds are invested in the Target Retirement Funds described below, unless other investments are selected.

If you were hired prior to July 1, 2008, you were not automatically enrolled in the 403(b) Plan. If you have not already elected to contribute to this plan, you may do so at any time.

Click here for the required auto enrollment notice.

The Archdiocesan Matching Contributions

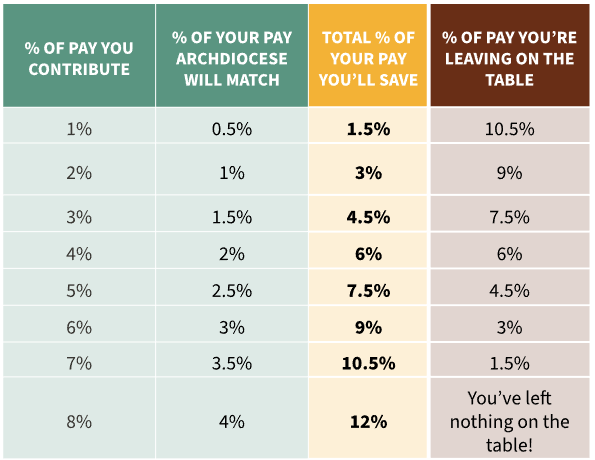

To encourage and help you save for your own financial security, we match 50% of the first 8% of pay you contribute to the Retirement Savings Plan. That’s an automatic 50% return on your investment! It means you receive 50 cents for every dollar you invest of the first 8% of pay you contribute.

Do Not Leave Money on the Table!

Retirement Savings Plan Vesting

Vesting refers to your “ownership” of the money in the plan. You are always 100% vested in the money you contribute, plus any investment earnings they generate. Our matching contribution also vests immediately.

Investments and Fees

Effective April 1, 2008, our plans began offering Target Retirement Funds that invest according to your projected retirement date (age 65). As you get closer to retirement, the investment mix changes automatically, eliminating the need to “rebalance” your investments over time. You may also choose among a selection of other investment funds offered through OneAmerica, the company that manages our Retirement Savings Plan.

An average administrative fee of $14.00 per quarter will be paid from your account depending on your active investment funds.

Hardship Withdrawals

If eligible, you may withdraw your contributions from your Retirement Savings Plan account balance under specific conditions of financial hardship. An employee may only take on hardship per calendar year. These conditions include:

• medical hardship,

• purchase of your primary residence,

• tuition payments for post-secondary education for yourself, your spouse, your children or your dependents, or

• in the event of eviction or foreclosure or damage to your home by force of nature or

• for burial of yourself or a dependent.

Note: if you take a hardship withdraw your contributions will continue

Receiving Your Retirement Savings Plan Benefits

You may begin receiving benefits (making withdrawals) from your account as early as age 59 1/2 without penalties. After your employment has ended, and you meet the required minimum distribution age (RMD) you will be notified by the 403b vednor of your options. Your benefits become taxable as income when you begin receiving them. Many pay-out options are available. You may elect a lump-sum or partial lump sum payment. Or, you may decide to receive periodic distributions from your account.

Issues to Consider

Beneficiary Designations

It’s important to review your beneficiary designations each year. Things change – please take the time to make sure that your family is provided for in the event of your death. You can update your beneficiary information online at //pages.oneamerica.com/archindyretire.

Retirement Planning

Knowing how much to save is almost as important as saving! Take advantage of the services that OneAmerica offers to prepare for your retirement now.

You’ll find tools to help you assess your retirement savings needs at //pages.oneamerica.com/archindyretire.